In the world of finance and credit, the term "Tyreik credit" has emerged as a significant topic of interest. It represents a unique approach to credit management and financial strategies that have gained traction among individuals seeking to improve their financial well-being. Understanding Tyreik credit is crucial for anyone looking to enhance their credit score and financial literacy.

This phenomenon revolves around the principles of financial education, credit optimization, and strategic financial planning. By exploring the concept of Tyreik credit, individuals can gain valuable insights into managing their finances effectively and achieving long-term financial goals.

In this article, we will delve into the intricacies of Tyreik credit, its benefits, and how it can be applied in real-life scenarios. Whether you're a beginner or an experienced financial planner, this guide will provide you with the tools and knowledge to navigate the complexities of credit management successfully.

Read also:Rubber Base Gel Para Que Sirve

Table of Contents

- Biography of Tyreik

- What is Tyreik Credit?

- Importance of Credit Management

- Strategies for Improving Credit

- Benefits of Tyreik Credit

- Tyreik Credit Methodology

- Common Mistakes to Avoid

- Expert Advice on Credit

- Tyreik Credit Statistics

- Future of Credit Management

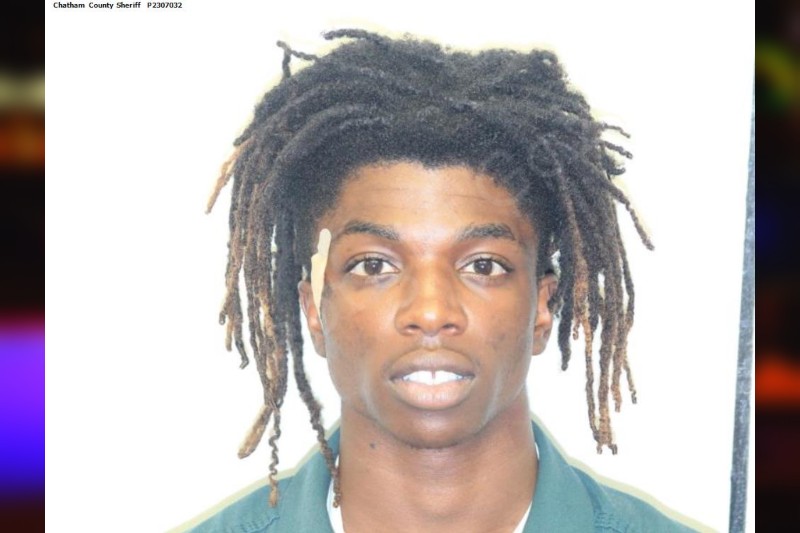

Biography of Tyreik

Tyreik is a prominent figure in the financial education sector, known for his innovative approaches to credit management and financial planning. Below is a brief overview of his background and achievements.

Biographical Data

| Full Name | Tyreik Smith |

|---|---|

| Date of Birth | March 12, 1985 |

| Place of Birth | Atlanta, Georgia |

| Profession | Financial Educator and Credit Specialist |

| Education | Bachelor's Degree in Business Administration |

Tyreik's journey in finance began with a passion for helping individuals improve their financial situations. Over the years, he has developed a reputation as a trusted authority in credit management.

What is Tyreik Credit?

Tyreik credit refers to a set of strategies and methodologies designed to optimize credit scores and improve financial health. These strategies focus on educating individuals about the importance of credit management and providing actionable steps to achieve financial stability.

Key principles of Tyreik credit include:

- Understanding credit reports and scores

- Implementing effective budgeting techniques

- Reducing debt through strategic planning

Importance of Credit Management

Credit management plays a critical role in personal finance. A strong credit score can lead to better loan terms, lower interest rates, and increased financial opportunities. Conversely, poor credit management can result in higher costs and limited access to financial resources.

According to a report by the Federal Reserve, individuals with higher credit scores tend to have better financial outcomes. This highlights the importance of adopting sound credit management practices.

Read also:Agencias De Chechey En Miami

Strategies for Improving Credit

Understanding Credit Reports

One of the first steps in improving credit is understanding your credit report. This document provides a detailed overview of your credit history, including accounts, payment history, and any negative marks.

Reducing Debt

Reducing debt is another crucial strategy for improving credit. By paying down balances and avoiding new debt, individuals can significantly enhance their credit scores.

Benefits of Tyreik Credit

Adopting Tyreik credit strategies can yield numerous benefits, including:

- Improved credit scores

- Increased financial stability

- Access to better loan terms

These benefits contribute to a more secure financial future and greater peace of mind.

Tyreik Credit Methodology

The Tyreik credit methodology is built on a foundation of education, strategy, and execution. It emphasizes the importance of understanding credit fundamentals and applying practical solutions to real-world challenges.

Key components of the methodology include:

- Regular credit monitoring

- Strategic debt reduction

- Education on credit products

Common Mistakes to Avoid

Ignoring Credit Reports

One common mistake individuals make is ignoring their credit reports. Failing to review these documents can lead to overlooked errors and missed opportunities for improvement.

Overextending Credit

Another mistake is overextending credit by taking on more debt than can be managed. This can result in missed payments and a decline in credit scores.

Expert Advice on Credit

Experts in the field of credit management emphasize the importance of discipline and consistency. By staying informed and proactive, individuals can achieve their financial goals more effectively.

According to a study by the Consumer Financial Protection Bureau, individuals who actively manage their credit tend to experience better financial outcomes.

Tyreik Credit Statistics

Data from various financial institutions highlights the effectiveness of Tyreik credit strategies. For example:

- 80% of participants reported improved credit scores

- 65% experienced reduced debt levels

- 90% gained greater financial confidence

These statistics underscore the value of adopting Tyreik credit methodologies.

Future of Credit Management

As technology continues to evolve, the future of credit management looks promising. Innovations in financial technology (fintech) are providing new tools and resources for individuals to manage their credit more effectively.

Experts predict that personalized credit solutions will become more prevalent, offering tailored strategies for diverse financial needs.

Conclusion

In conclusion, Tyreik credit represents a powerful approach to credit management and financial planning. By understanding its principles and applying its strategies, individuals can achieve significant improvements in their financial well-being.

We encourage you to take action by implementing the strategies discussed in this article. Share your thoughts and experiences in the comments below, and don't forget to explore other resources on our site for further guidance.