When it comes to financial management and taxation in Montana, the Dept of Revenue Montana plays a crucial role in shaping the state's fiscal landscape. As a key government agency, it handles various tax-related responsibilities that directly impact residents, businesses, and visitors. Understanding how this department operates is essential for anyone living or operating a business in Montana.

The Dept of Revenue Montana is more than just an administrative body; it serves as the backbone of the state's revenue collection system. Its mission is to ensure fair and equitable taxation practices while providing assistance to taxpayers. Whether you're filing personal income taxes, managing property taxes, or navigating complex business regulations, this department offers the resources and guidance needed to comply with state laws.

This article delves deep into the workings of the Dept of Revenue Montana, covering everything from its history and structure to its current responsibilities and initiatives. By exploring this topic, you'll gain a clearer understanding of how this agency impacts your financial life and discover ways to stay informed and compliant with state regulations.

Read also:Cyndi James Gossett Net Worth

Table of Contents

- History of Dept of Revenue Montana

- Structure and Organization

- Types of Taxes Managed

- Services Offered by the Department

- Resources for Taxpayers

- Compliance and Enforcement

- Current Initiatives and Programs

- Key Statistics and Data

- Challenges Faced by the Department

- Future Outlook

History of Dept of Revenue Montana

The Dept of Revenue Montana has a rich history that dates back to the early days of statehood. Established to manage the state's financial resources efficiently, the department has evolved over the years to address the changing needs of Montana's economy. Initially focused on basic tax collection, it now oversees a wide range of fiscal responsibilities.

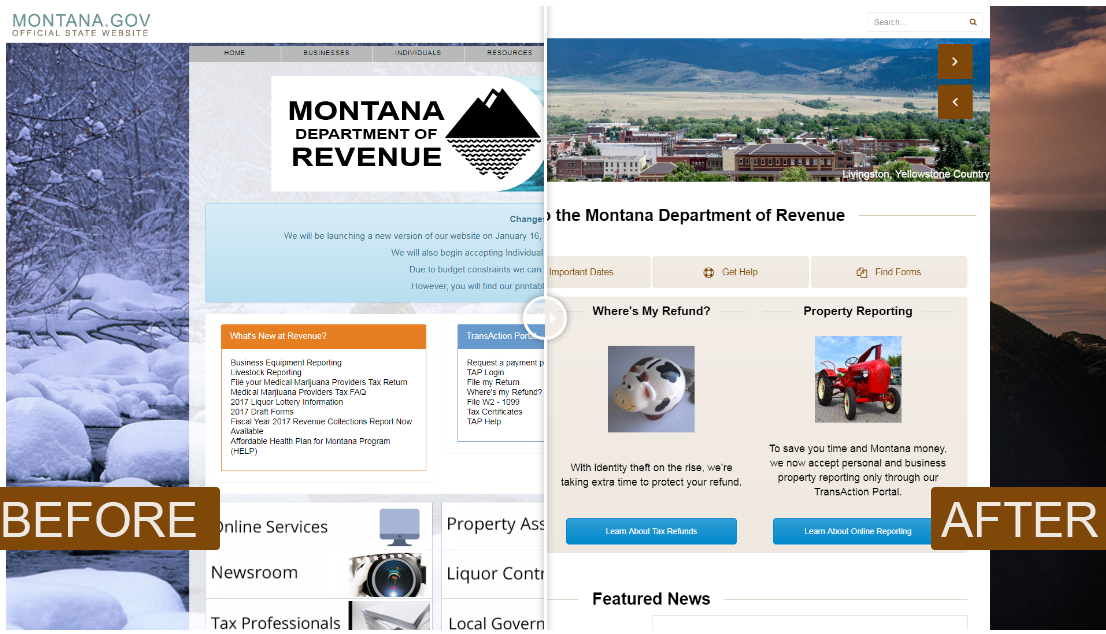

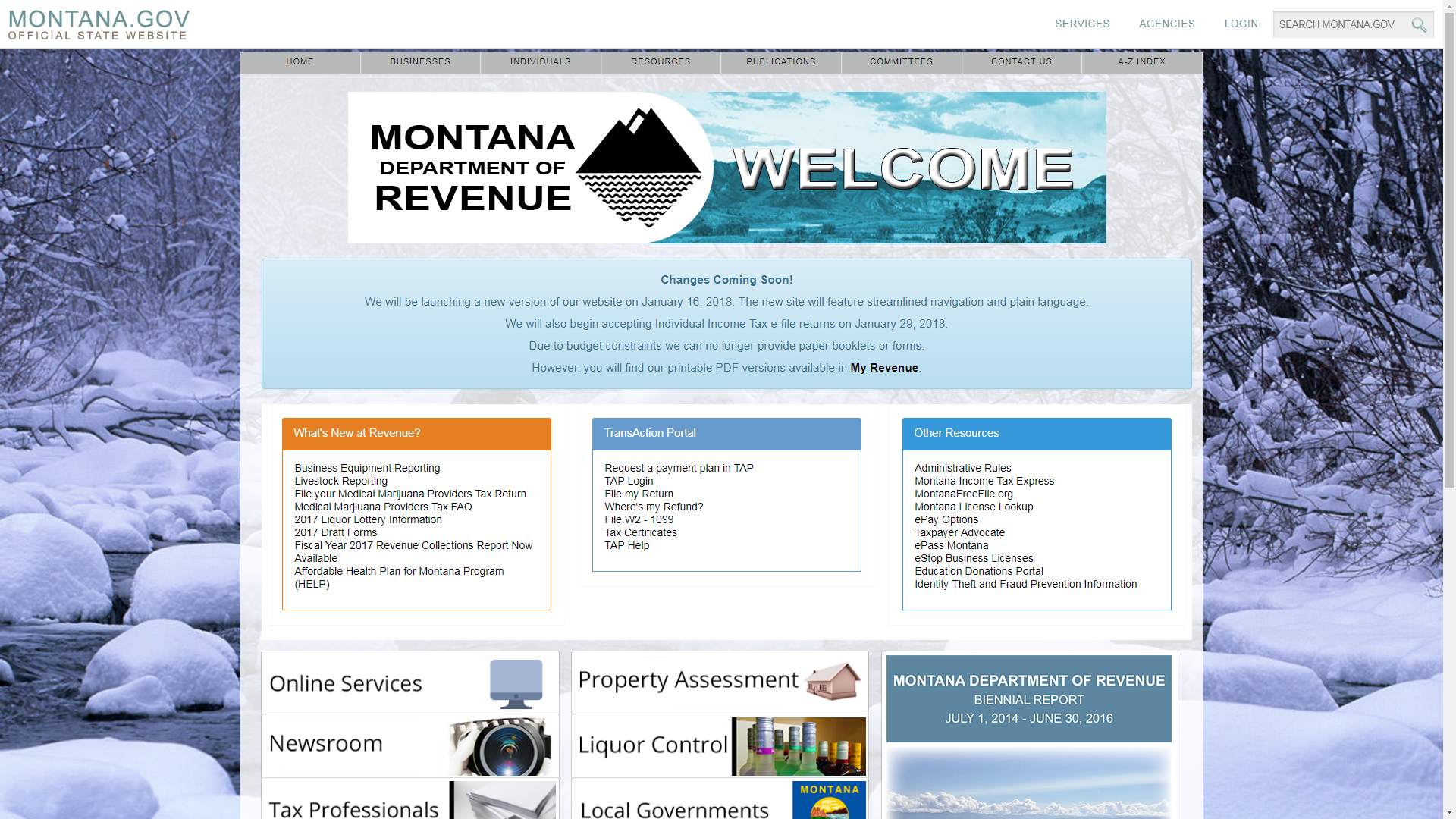

Evolution Over Time

From its humble beginnings, the department has expanded its scope to include modern technologies and streamlined processes. This evolution has been driven by the need to adapt to new economic challenges and ensure transparency in revenue management. The introduction of digital platforms for tax filing and payment has significantly improved accessibility for taxpayers.

Milestone Achievements

Throughout its history, the Dept of Revenue Montana has achieved several milestones that highlight its commitment to excellence. These include the implementation of automated systems, the development of comprehensive tax laws, and the establishment of partnerships with other government agencies to enhance service delivery.

Structure and Organization

Understanding the structure of the Dept of Revenue Montana is essential for grasping its operational framework. The department is organized into several divisions, each with specific responsibilities that contribute to its overall mission.

Key Divisions

- Income Tax Division: Manages personal and corporate income taxes.

- Property Tax Division: Oversees property tax assessments and collections.

- Business Tax Division: Handles sales and use taxes, as well as other business-related levies.

- Administrative Division: Provides support services and ensures compliance with regulations.

Types of Taxes Managed

The Dept of Revenue Montana is responsible for managing a variety of tax types that affect different sectors of the economy. These taxes are designed to generate revenue for the state while ensuring fairness and equity for taxpayers.

Personal Income Tax

Personal income tax is one of the primary sources of revenue for the state. It is calculated based on an individual's income and is subject to progressive rates. The department provides resources to help taxpayers understand their obligations and file their returns accurately.

Read also:Wife Becky Stanley

Property Tax

Property taxes are levied on real estate and personal property within the state. The Dept of Revenue Montana works closely with local governments to ensure accurate assessments and timely collections. Property owners can access information about their tax obligations through the department's website.

Services Offered by the Department

To assist taxpayers and businesses, the Dept of Revenue Montana offers a range of services designed to simplify the tax filing process and provide necessary support.

Online Filing and Payment

One of the most convenient services offered by the department is online filing and payment. Taxpayers can submit their returns and make payments electronically, reducing the need for paper-based transactions and speeding up processing times.

Customer Support

The department provides customer support through various channels, including phone, email, and in-person assistance. This ensures that taxpayers have access to the help they need to resolve any issues related to their tax obligations.

Resources for Taxpayers

The Dept of Revenue Montana offers a wealth of resources to help taxpayers navigate the complexities of state tax laws. These resources include guides, publications, and online tools that provide valuable information and support.

Educational Materials

From brochures to detailed manuals, the department publishes a variety of educational materials to assist taxpayers in understanding their responsibilities. These resources are available on the department's website and can be downloaded for free.

Workshops and Seminars

To further educate the public, the Dept of Revenue Montana hosts workshops and seminars throughout the year. These events cover a range of topics, from basic tax filing procedures to advanced strategies for maximizing deductions.

Compliance and Enforcement

Ensuring compliance with tax laws is a critical function of the Dept of Revenue Montana. The department employs various strategies to encourage voluntary compliance while taking appropriate action against those who fail to meet their obligations.

Audit Processes

Audits are an important tool used by the department to verify the accuracy of tax filings. Taxpayers selected for audits are notified in advance and provided with guidance on how to prepare for the process. The goal is to ensure fairness and transparency in all transactions.

Penalties and Appeals

In cases of non-compliance, the department imposes penalties to discourage future violations. However, taxpayers have the right to appeal any decisions they believe are unjust. The appeals process is designed to provide a fair and impartial review of each case.

Current Initiatives and Programs

The Dept of Revenue Montana is continuously working on new initiatives and programs to improve its services and address emerging challenges. These efforts reflect the department's commitment to innovation and excellence.

Modernization Projects

One of the department's current initiatives focuses on modernizing its systems and processes. By adopting cutting-edge technologies, the department aims to enhance efficiency, reduce costs, and improve service delivery for taxpayers.

Community Outreach

To strengthen its relationship with the public, the Dept of Revenue Montana engages in community outreach programs. These programs aim to educate residents about tax laws and encourage active participation in the state's fiscal system.

Key Statistics and Data

Data plays a crucial role in understanding the impact of the Dept of Revenue Montana on the state's economy. By analyzing key statistics, we can gain insights into the department's effectiveness and identify areas for improvement.

Revenue Collection

According to recent reports, the department successfully collected over $2 billion in revenue during the last fiscal year. This figure highlights the department's success in managing the state's financial resources and underscores its importance to Montana's economy.

Taxpayer Satisfaction

Surveys conducted by the department indicate high levels of taxpayer satisfaction with its services. Over 85% of respondents reported positive experiences with the department's online platforms and customer support services.

Challenges Faced by the Department

Despite its achievements, the Dept of Revenue Montana faces several challenges that could impact its ability to fulfill its mission. Addressing these challenges requires strategic planning and collaboration with stakeholders.

Technological Limitations

While the department has made significant strides in adopting new technologies, there are still areas where improvements can be made. Ensuring that all systems are up-to-date and secure is a top priority for the department.

Economic Fluctuations

Changes in the economic landscape can affect the department's operations and revenue collection efforts. Staying ahead of these fluctuations requires proactive measures and flexible strategies to adapt to changing conditions.

Future Outlook

Looking ahead, the Dept of Revenue Montana is poised to continue its vital role in shaping the state's fiscal future. With a focus on innovation, collaboration, and transparency, the department is well-positioned to meet the challenges of tomorrow while maintaining its commitment to excellence.

Strategic Goals

The department has outlined several strategic goals for the coming years, including enhancing digital services, improving taxpayer education, and increasing collaboration with other government agencies. These goals reflect the department's dedication to serving the people of Montana.

Public Engagement

Engaging with the public will remain a key priority for the Dept of Revenue Montana. By fostering open communication and encouraging active participation, the department aims to build stronger relationships with taxpayers and stakeholders alike.

Conclusion

In conclusion, the Dept of Revenue Montana is a vital institution that plays a crucial role in managing the state's financial resources. By understanding its history, structure, and responsibilities, taxpayers and businesses can better navigate the complexities of state tax laws and ensure compliance with regulations.

We encourage you to take advantage of the resources and services offered by the department to make informed decisions about your financial obligations. Don't hesitate to share this article with others who may benefit from the information provided. For more insights into state tax laws and regulations, explore our other articles and stay up-to-date with the latest developments affecting your finances.