Capital One Bank, one of the leading financial institutions in the United States, has revolutionized the banking industry with its customer-centric approach and innovative solutions. Whether you're looking for a reliable credit card, a savings account, or a loan, Capital One Bank offers a wide range of products designed to meet the needs of modern consumers. Understanding the services offered by Capital One Bank and how to access their customer support line at 1-800-Capital-One can significantly enhance your banking experience.

In today's fast-paced world, having access to quality banking services is crucial. Capital One Bank stands out for its commitment to providing seamless digital banking experiences, competitive interest rates, and robust customer support. Whether you're managing your finances online or seeking assistance through their toll-free hotline, Capital One Bank ensures that you have all the tools necessary to make informed financial decisions.

This comprehensive guide will explore the features, services, and benefits of Capital One Bank, including how to contact their customer service through the 1-800-Capital-One number. By the end of this article, you'll have a thorough understanding of why Capital One Bank is a top choice for millions of Americans and how you can maximize the value of their offerings.

Read also:Why Is Ari Melber Not On His Show This Week Exploring The Reasons Behind His Absence

Table of Contents

- Introduction to Capital One Bank

- Key Services Offered by Capital One Bank

- Understanding the Importance of Capital One Bank 1800

- A Brief History of Capital One Bank

- Capital One's Digital Banking Solutions

- Exploring Capital One Credit Cards

- Loan Options Available at Capital One Bank

- Savings Accounts and Investment Opportunities

- Capital One Bank's Security Measures

- Comparing Capital One Bank with Other Financial Institutions

- Conclusion and Next Steps

Introduction to Capital One Bank

Capital One Bank, founded in 1988, has grown to become one of the largest banks in the United States. Known for its innovative approach to banking, Capital One Bank offers a wide array of financial products and services that cater to both individual and business customers. From credit cards to loans, savings accounts, and investment opportunities, Capital One Bank provides solutions that empower consumers to achieve their financial goals.

One of the standout features of Capital One Bank is its commitment to customer service. The bank's toll-free customer support line, accessible at 1-800-Capital-One, ensures that customers have a reliable point of contact for any inquiries or issues they may encounter. This dedication to service has earned Capital One Bank a reputation for excellence and reliability.

Why Choose Capital One Bank?

Choosing Capital One Bank means gaining access to a suite of financial tools designed to simplify your financial life. The bank's emphasis on innovation, coupled with its competitive rates and personalized service, makes it an attractive option for those seeking a trusted banking partner. Additionally, Capital One Bank's robust digital platform offers unparalleled convenience, allowing customers to manage their accounts effortlessly from anywhere.

Key Services Offered by Capital One Bank

Capital One Bank offers a diverse range of services tailored to meet the needs of its customers. These services include credit cards, loans, savings accounts, and investment opportunities, each designed to provide value and flexibility. Understanding these offerings can help you make informed decisions about your financial future.

1. Credit Cards

Capital One Bank is renowned for its extensive selection of credit cards, each offering unique benefits. From cashback rewards to travel perks, Capital One's credit card lineup caters to a variety of consumer preferences. Popular cards include:

- Capital One Venture Rewards Credit Card

- Capital One Quicksilver Cash Rewards Credit Card

- Capital One Savor Cash Rewards Credit Card

2. Loans

Whether you're looking to consolidate debt, finance a major purchase, or invest in your business, Capital One Bank offers a range of loan options. These loans are designed to provide competitive rates and flexible terms, making them an attractive choice for borrowers.

Read also:Sophie Rain If Leak Exploring The Controversy Facts And Insights

Understanding the Importance of Capital One Bank 1800

Capital One Bank's customer support line, reachable at 1-800-Capital-One, plays a crucial role in ensuring customer satisfaction. This toll-free number provides direct access to knowledgeable representatives who can assist with account inquiries, transaction disputes, and other banking-related issues. By maintaining a dedicated customer service team, Capital One Bank demonstrates its commitment to delivering exceptional service.

How to Contact Capital One Bank Customer Support

Reaching out to Capital One Bank's customer support team is straightforward. Simply dial 1-800-Capital-One to speak with a representative who can address your concerns. Additionally, Capital One Bank offers online chat and email support options for customers who prefer digital communication methods.

A Brief History of Capital One Bank

Established in 1988, Capital One Bank began as a division of Signet Bank before becoming an independent entity in 1994. Over the years, the bank has expanded its operations through strategic acquisitions and investments in technology. Today, Capital One Bank is a Fortune 500 company with millions of satisfied customers across the United States.

Capital One Bank's Milestones

- 1988: Founded as a credit card division of Signet Bank

- 1994: Became an independent company

- 2005: Acquired Chevy Chase Bank

- 2019: Expanded digital banking capabilities

Capital One's Digital Banking Solutions

Capital One Bank has embraced the digital age by offering cutting-edge online and mobile banking solutions. These platforms allow customers to manage their accounts, view transaction histories, and make payments from the comfort of their homes or on the go. The Capital One Mobile app, available on both iOS and Android, provides a seamless user experience and enhances customer convenience.

Features of Capital One's Digital Banking

- Account management

- Bill payments

- Transaction notifications

- Mobile check deposit

Exploring Capital One Credit Cards

Capital One Bank's credit card offerings are designed to cater to a wide range of consumer needs. From cashback rewards to travel benefits, these cards provide value and flexibility. Customers can choose from a variety of options, each tailored to specific preferences and spending habits.

Benefits of Capital One Credit Cards

- Competitive rewards programs

- No annual fees on most cards

- Flexible payment options

- Robust fraud protection

Loan Options Available at Capital One Bank

Capital One Bank offers a variety of loan options to meet the financial needs of its customers. These loans include personal loans, auto loans, and business loans, each designed to provide competitive rates and flexible terms. By offering diverse loan products, Capital One Bank ensures that customers can find the right solution for their financial goals.

Types of Loans Offered

- Personal loans

- Auto loans

- Business loans

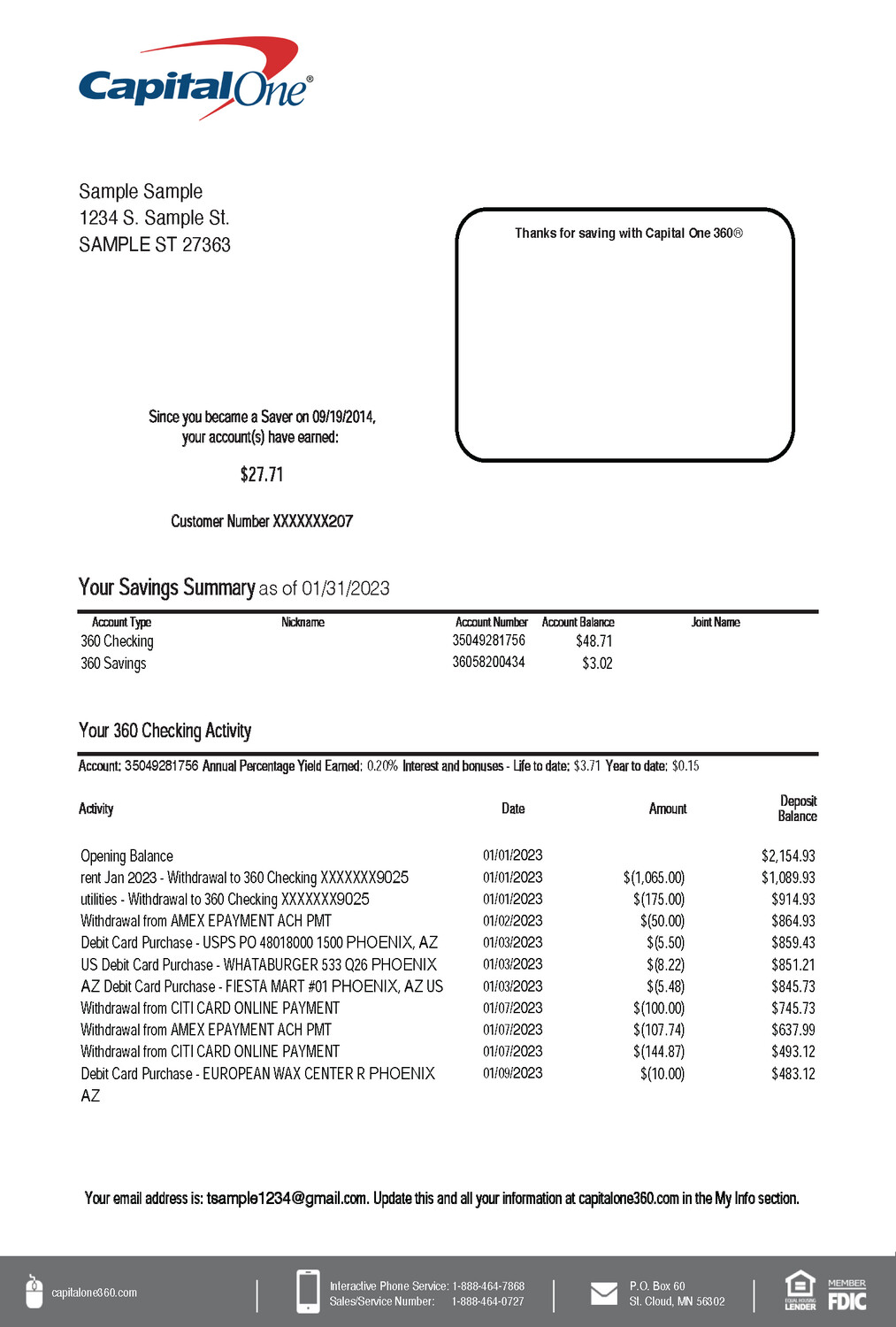

Savings Accounts and Investment Opportunities

Capital One Bank provides a range of savings accounts and investment opportunities designed to help customers grow their wealth. These accounts offer competitive interest rates and are backed by the security of FDIC insurance, ensuring peace of mind for account holders.

Key Savings Accounts

- 360 Savings Account

- Money Market Account

- Certificate of Deposit (CD)

Capital One Bank's Security Measures

Security is a top priority at Capital One Bank. The bank employs advanced encryption technologies and multi-factor authentication to protect customer data and prevent unauthorized access. Additionally, Capital One Bank offers fraud monitoring services to help customers stay vigilant against potential threats.

Security Features

- Advanced encryption

- Multi-factor authentication

- Fraud monitoring

Comparing Capital One Bank with Other Financial Institutions

When comparing Capital One Bank with other financial institutions, several factors stand out. Capital One Bank's innovative approach to banking, coupled with its competitive rates and robust customer service, makes it a standout choice for consumers. Additionally, the bank's commitment to digital transformation ensures that customers have access to the latest technologies and tools to manage their finances effectively.

Conclusion and Next Steps

Capital One Bank has established itself as a leader in the banking industry through its innovative products, competitive rates, and exceptional customer service. By offering a wide range of services and maintaining a dedicated customer support line at 1-800-Capital-One, Capital One Bank ensures that customers have the resources they need to achieve their financial goals.

We encourage you to explore the various offerings from Capital One Bank and consider how they can benefit your financial future. For more information or to speak with a representative, don't hesitate to contact Capital One Bank at 1-800-Capital-One. Additionally, feel free to leave a comment or share this article with others who may find it valuable. Together, let's build a brighter financial future.