Saving for your child's education is one of the most important financial decisions you can make. Whether you're considering the Gerber College Plan or a 529 plan, understanding the differences and benefits of each option is crucial. Both plans aim to provide financial support for higher education, but they come with distinct features that may suit different needs.

As the cost of higher education continues to rise, families are increasingly looking for ways to secure their children's future. The Gerber College Plan and 529 plans are two popular options that have gained attention. Both offer tax advantages and flexibility, but it's essential to evaluate which plan aligns best with your financial goals and circumstances.

This article will provide a detailed comparison of the Gerber College Plan and 529 plans, helping you make an informed decision. By the end, you'll have a clearer understanding of the features, benefits, and potential drawbacks of each option, ensuring you're prepared for your child's educational journey.

Read also:Strong Woman Keep Your Head Up Quotes

Table of Contents

- Introduction

- Overview of Gerber College Plan

- Overview of 529 Plans

- Gerber College Plan vs 529: Key Differences

- Tax Advantages and Benefits

- Eligibility Requirements

- Flexibility and Withdrawal Options

- Costs and Fees

- Investment Options

- Expert Recommendations

- Conclusion

Overview of Gerber College Plan

The Gerber College Plan, offered by Gerber Life Insurance Company, is a unique way to save for your child's education. This plan is essentially a life insurance policy designed to accumulate cash value over time, which can later be used for educational expenses.

How It Works

With the Gerber College Plan, you pay a fixed premium for 20 years. At the end of this period, the policy matures, and the accumulated cash value can be used to pay for college expenses. If the insured child dies before the policy matures, the death benefit provides financial security for the family.

- Fixed premiums for 20 years

- Guaranteed cash value at maturity

- Death benefit protection

Overview of 529 Plans

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. These plans are sponsored by states, state agencies, or educational institutions and are authorized by Section 529 of the Internal Revenue Code.

Types of 529 Plans

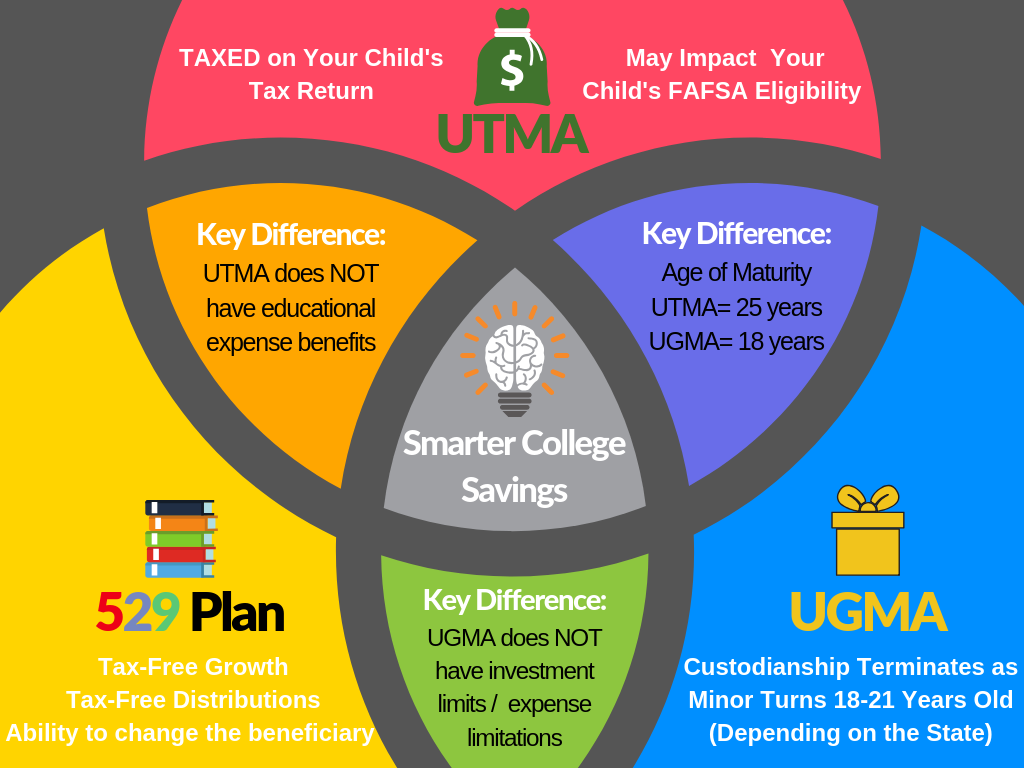

There are two main types of 529 plans: prepaid tuition plans and education savings plans. Prepaid tuition plans allow you to lock in today's tuition rates, while education savings plans offer more flexibility with investment options.

- Prepaid tuition plans

- Education savings plans

Gerber College Plan vs 529: Key Differences

While both the Gerber College Plan and 529 plans aim to help families save for education, they differ significantly in structure, benefits, and limitations.

Structure

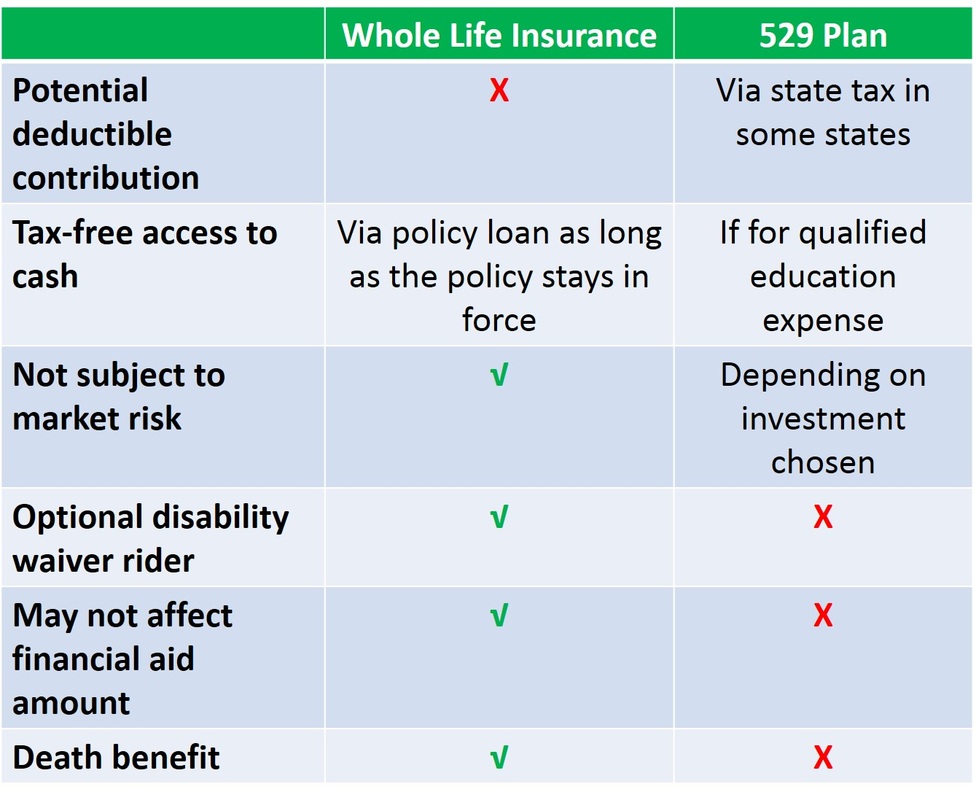

The Gerber College Plan operates as a life insurance policy, providing a guaranteed cash value at maturity. On the other hand, 529 plans are investment accounts that offer tax advantages but come with market risks.

Read also:Mens Ear Tattoos

Benefits

One of the main benefits of the Gerber College Plan is the guaranteed cash value and death benefit. Meanwhile, 529 plans offer tax-free growth and withdrawals when used for qualified education expenses.

Tax Advantages and Benefits

Both the Gerber College Plan and 529 plans offer tax advantages, but they differ in how these benefits are structured.

Gerber College Plan Tax Benefits

The Gerber College Plan does not provide direct tax advantages like a 529 plan. However, the cash value grows tax-deferred, and withdrawals are generally tax-free if used for education expenses.

529 Plan Tax Benefits

529 plans offer significant tax benefits, including tax-free growth and withdrawals for qualified education expenses. Additionally, some states offer tax deductions or credits for contributions to 529 plans.

Eligibility Requirements

Understanding the eligibility requirements for each plan is essential to determine which option is right for you.

Gerber College Plan Eligibility

The Gerber College Plan is available for children up to age 15. The plan requires a fixed premium payment schedule over 20 years, making it important to evaluate your financial commitment upfront.

529 Plan Eligibility

529 plans have no age restrictions and allow contributions from anyone, regardless of income. However, there may be contribution limits depending on the state sponsoring the plan.

Flexibility and Withdrawal Options

Flexibility is a critical factor when choosing between the Gerber College Plan and 529 plans.

Gerber College Plan Flexibility

The Gerber College Plan offers limited flexibility. Once the policy matures, the cash value can be used for education expenses, but there are no investment options or market exposure.

529 Plan Flexibility

529 plans provide greater flexibility, allowing you to choose from a variety of investment options. Additionally, funds can be transferred to other family members if the original beneficiary does not attend college.

Costs and Fees

Understanding the costs associated with each plan is crucial for long-term planning.

Gerber College Plan Costs

The Gerber College Plan involves fixed premiums for 20 years. While there are no additional fees, the cash value growth is typically lower compared to investment-based options.

529 Plan Costs

529 plans may involve enrollment fees, maintenance fees, and investment management fees. However, these costs can vary significantly depending on the state and plan provider.

Investment Options

Investment options are a key consideration when comparing the Gerber College Plan and 529 plans.

Gerber College Plan Investments

The Gerber College Plan does not offer investment options. Instead, it provides a guaranteed cash value based on fixed premiums.

529 Plan Investments

529 plans offer a wide range of investment options, including mutual funds, ETFs, and age-based portfolios. This allows you to tailor your investments to your risk tolerance and financial goals.

Expert Recommendations

Financial experts recommend evaluating your specific needs and circumstances when choosing between the Gerber College Plan and 529 plans.

When to Choose Gerber College Plan

Consider the Gerber College Plan if you prioritize guaranteed cash value, death benefit protection, and a straightforward savings structure.

When to Choose 529 Plan

Choose a 529 plan if you prefer tax advantages, investment flexibility, and the potential for higher returns, despite market risks.

Conclusion

In conclusion, both the Gerber College Plan and 529 plans offer valuable ways to save for your child's education. The Gerber College Plan provides guaranteed cash value and death benefit protection, while 529 plans offer tax advantages and investment flexibility.

We encourage you to carefully evaluate your financial goals, risk tolerance, and family needs before making a decision. For further guidance, consult with a financial advisor who can help tailor a plan to your unique situation. Don't forget to share your thoughts in the comments or explore other articles on our site for more insights into education planning.