When it comes to securing a loan, Granite State Credit Union offers a range of financial solutions designed to meet the needs of its members. Whether you're looking to buy a home, finance a car, or consolidate debt, this credit union stands out as a trusted financial partner. With competitive interest rates and personalized service, Granite State Credit Union Loan options cater to a variety of financial goals.

Granite State Credit Union has built a reputation for providing reliable and affordable loan products. Established with a focus on community and member satisfaction, the credit union aims to empower individuals through accessible financial services. This article will explore the various loan offerings, the application process, and the benefits of choosing Granite State Credit Union for your financial needs.

As you delve deeper into this guide, you'll uncover valuable insights into the loan products available, eligibility criteria, and how to maximize the benefits of becoming a member. By the end of this article, you'll have a comprehensive understanding of why Granite State Credit Union Loan services are worth considering.

Read also:Enrica Cenzatti Today

Table of Contents

- Introduction to Granite State Credit Union Loan

- Types of Loans Offered by Granite State Credit Union

- Eligibility Requirements

- The Loan Application Process

- Understanding Interest Rates

- Benefits of Being a Member

- Advantages of Credit Union Loans

- Customer Support and Resources

- Member Testimonials

- Frequently Asked Questions

Introduction to Granite State Credit Union Loan

Granite State Credit Union Loan services are designed to cater to the diverse financial needs of its members. From personal loans to mortgages, the credit union offers a wide array of loan products tailored to help individuals achieve their financial goals. By prioritizing member satisfaction and offering competitive rates, Granite State Credit Union has become a go-to institution for those seeking reliable financing options.

One of the key advantages of choosing Granite State Credit Union is the personalized service they provide. Unlike traditional banks, credit unions operate as member-owned cooperatives, ensuring that the needs of their members are always at the forefront. This commitment to member-centric service is evident in the loan products and support they offer.

Types of Loans Offered by Granite State Credit Union

Personal Loans

Personal loans from Granite State Credit Union can be used for a variety of purposes, such as home renovations, medical expenses, or vacation funding. These loans typically come with fixed interest rates and repayment terms, making them an attractive option for those seeking predictable monthly payments.

Auto Loans

Granite State Credit Union provides competitive auto loan options for both new and used vehicles. With flexible terms and low interest rates, members can finance their dream car without breaking the bank. Additionally, the credit union offers resources to help members make informed purchasing decisions.

Mortgage Loans

For those looking to purchase a home, Granite State Credit Union offers mortgage loans with competitive rates and personalized service. Their mortgage specialists work closely with members to find the best financing solution for their needs, whether it's a first-time homebuyer loan or a refinance option.

Eligibility Requirements

To qualify for a Granite State Credit Union Loan, individuals must first become members of the credit union. Membership is typically open to residents of specific geographic areas or employees of participating organizations. Once a member, individuals can apply for various loan products based on their financial needs and creditworthiness.

Read also:Appreciating A Good Man Quotes

- Residency in the designated service area

- Employment with a participating organization

- Good credit history

- Stable income source

The Loan Application Process

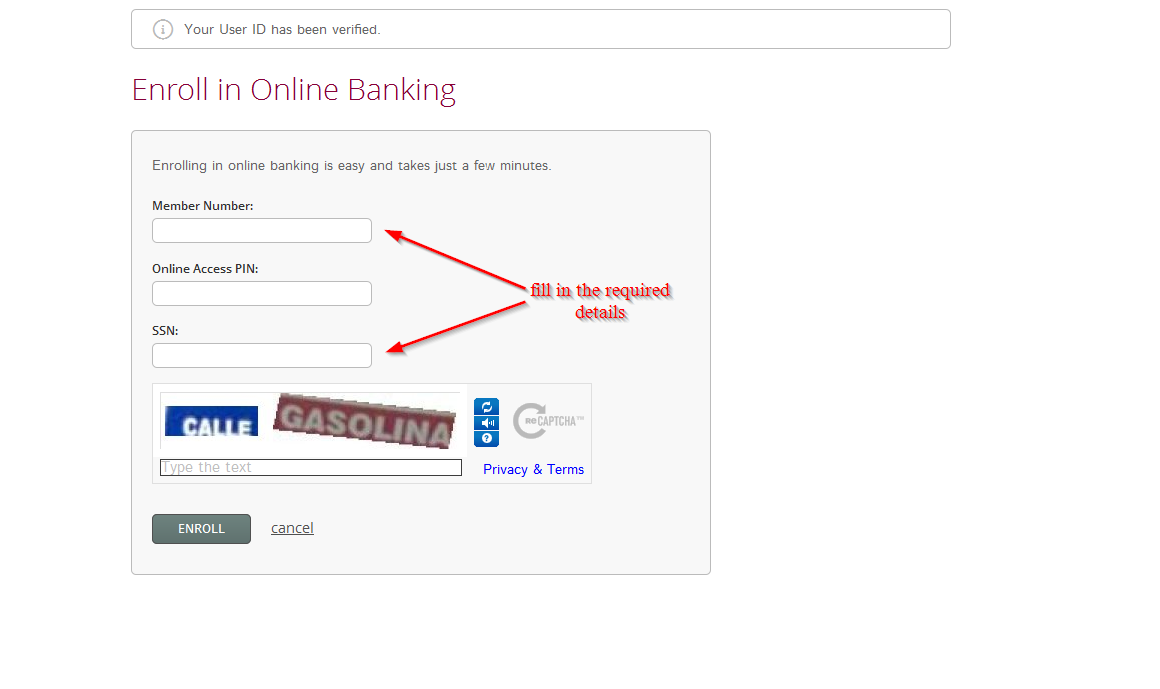

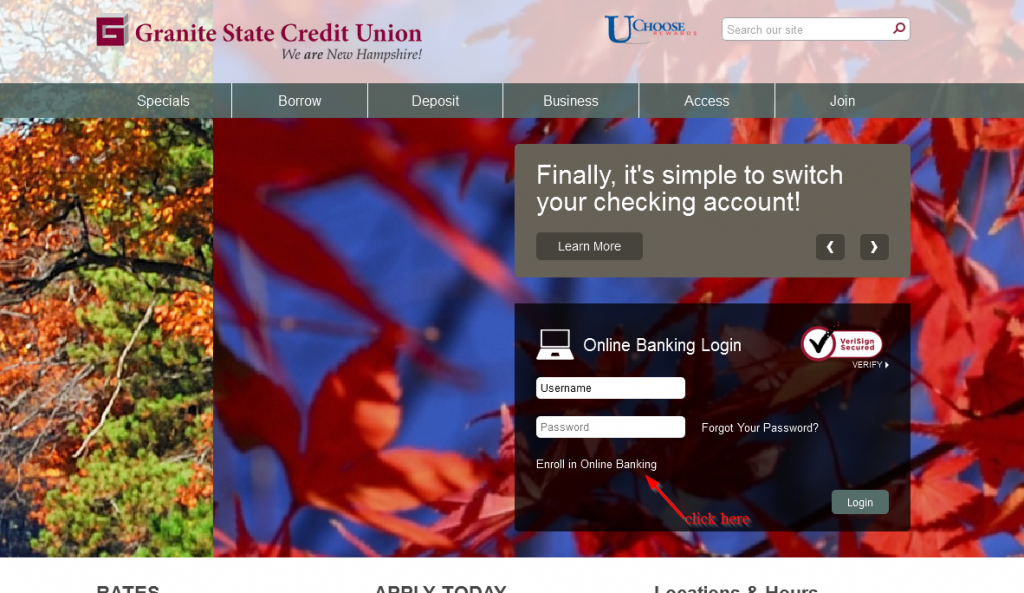

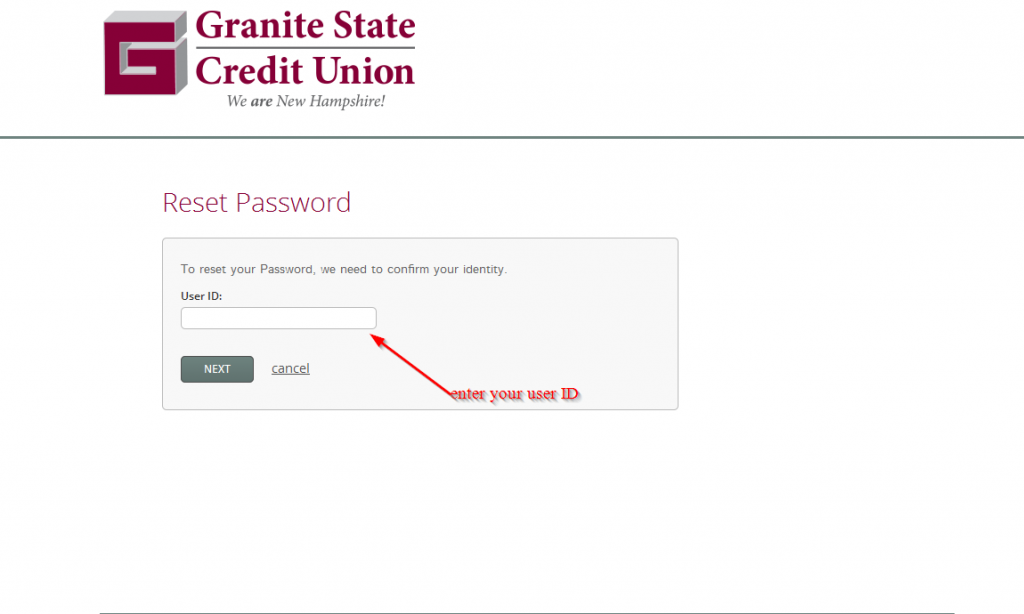

The loan application process at Granite State Credit Union is designed to be straightforward and efficient. Members can apply online, over the phone, or in person at one of the credit union's branches. The process involves submitting necessary documentation, such as proof of income and identification, and undergoing a credit check to determine eligibility.

Steps to Apply

- Complete the online application form or visit a branch

- Provide required documentation, including income verification

- Undergo a credit check and loan evaluation

- Receive a decision and finalize the loan agreement

Understanding Interest Rates

Interest rates for Granite State Credit Union Loans are competitive and often lower than those offered by traditional banks. The exact rate a member receives will depend on factors such as credit score, loan type, and repayment term. Members with higher credit scores and longer membership histories may qualify for more favorable rates.

For example, personal loans typically range from 7% to 18% APR, while auto loans may offer rates as low as 3.5% APR for qualified borrowers. Mortgage rates are also competitive, with fixed-rate options available for both 15-year and 30-year terms.

Benefits of Being a Member

Becoming a member of Granite State Credit Union comes with numerous benefits beyond just loan products. Members enjoy access to a wide range of financial services, including savings accounts, checking accounts, and investment opportunities. Additionally, the credit union offers financial education resources and tools to help members make informed decisions about their money.

Key Member Benefits

- Competitive loan rates

- Personalized service

- Financial education resources

- Access to a network of shared branching locations

Advantages of Credit Union Loans

Credit unions like Granite State Credit Union offer several advantages over traditional banks when it comes to loans. These include:

Lower Fees

Credit unions typically charge lower fees compared to banks, which can result in significant savings for members. This is because credit unions are not-for-profit organizations that prioritize member benefits over profit generation.

Member-Centric Service

The member-centric approach of credit unions ensures that individuals receive personalized attention and support throughout the loan process. This can lead to a more satisfying and stress-free experience for borrowers.

Customer Support and Resources

Granite State Credit Union provides excellent customer support to its members. Whether you need help with the loan application process or have questions about your account, the credit union's dedicated team is available to assist. Members can also access a variety of resources, including online banking tools, financial calculators, and educational materials.

Resources for Members

- Online banking and mobile apps

- Financial calculators and planning tools

- Workshops and seminars on financial literacy

Member Testimonials

Hearing from other members can provide valuable insight into the quality of service offered by Granite State Credit Union. Many members have praised the credit union for its competitive loan rates, personalized service, and commitment to member satisfaction.

"I was impressed with the ease of the loan application process and the competitive rates offered by Granite State Credit Union. The staff was incredibly helpful and made the entire experience stress-free."

Frequently Asked Questions

Q: How do I become a member of Granite State Credit Union?

A: To become a member, you must reside in the designated service area or be employed by a participating organization. Once eligible, you can complete the membership application process online or at a branch location.

Q: What types of loans does Granite State Credit Union offer?

A: Granite State Credit Union offers a variety of loan products, including personal loans, auto loans, and mortgage loans. Members can choose the option that best fits their financial needs.

Q: Are there any fees associated with applying for a loan?

A: Granite State Credit Union strives to minimize fees for its members. While some loan products may have associated fees, these are typically lower than those charged by traditional banks.

Conclusion

In conclusion, Granite State Credit Union Loan services offer a reliable and affordable solution for those seeking financial assistance. With competitive interest rates, personalized service, and a commitment to member satisfaction, the credit union stands out as a trusted financial partner. By becoming a member, individuals can access a wide range of loan products and enjoy the benefits of a member-centric institution.

We encourage you to take the next step by exploring the loan options available at Granite State Credit Union. Whether you're looking to finance a major purchase or consolidate debt, the credit union has the tools and resources to help you achieve your financial goals. Don't forget to leave a comment or share this article with others who may find it helpful!