Direct deposit has revolutionized the way people receive their salaries and other payments, and Chase Bank is one of the most popular financial institutions offering this service. However, as convenient as it is, users sometimes encounter Chase direct deposit issues that can disrupt their financial planning. If you're experiencing problems with your Chase direct deposit, this guide will walk you through common issues, their causes, and effective solutions.

Direct deposit is a secure and efficient method of transferring funds directly into your bank account. For millions of Americans, Chase Bank serves as their primary financial institution, making it essential to understand how the system works and what can go wrong. This article will delve into the most common Chase direct deposit issues, providing actionable advice to help you troubleshoot and resolve them.

Whether you're dealing with delayed deposits, incorrect amounts, or other complications, this guide is designed to empower you with the knowledge and tools to address these concerns effectively. By the end of this article, you'll have a clear understanding of how Chase direct deposit works and how to avoid or fix potential problems.

Read also:Ex Nba Players That Are Jehovah Witness

Table of Contents

- Introduction to Chase Direct Deposit

- Common Chase Direct Deposit Issues

- Causes of Delayed Deposits

- Incorrect Deposit Amounts

- Technical Glitches

- How to Resolve Chase Direct Deposit Issues

- Tips for Preventing Future Issues

- Contacting Chase Customer Support

- Alternatives to Chase Direct Deposit

- Conclusion

Introduction to Chase Direct Deposit

Chase Direct Deposit is a widely used service that allows employers, government agencies, and other entities to transfer funds directly into a customer's Chase Bank account. This method eliminates the need for paper checks, reducing the risk of fraud and ensuring timely payments. However, despite its many advantages, users occasionally face challenges that can hinder the smooth operation of this system.

Understanding how Chase Direct Deposit works is crucial for identifying potential issues. The process typically involves the employer setting up an electronic funds transfer (EFT) through their payroll system, which then sends the payment to Chase Bank. Once the bank receives the funds, they are credited to the customer's account on the scheduled deposit date.

Benefits of Chase Direct Deposit

- Fast and secure payment processing

- Reduction in the risk of lost or stolen checks

- Convenience of having funds automatically deposited

- Access to funds on the scheduled deposit date

Common Chase Direct Deposit Issues

While Chase Direct Deposit is generally reliable, several issues can arise that may cause frustration for users. Below are some of the most common problems encountered:

Delayed Deposits

One of the most frequent complaints is delayed deposits. This issue can occur due to various factors, including bank holidays, technical glitches, or errors in the payroll system. Understanding the causes of delayed deposits is the first step in resolving this problem.

Incorrect Deposit Amounts

Receiving an incorrect deposit amount is another common issue. This can happen if there is a mistake in the payroll system or if the wrong account information is provided. It's important to verify the details with your employer to ensure accuracy.

Technical Glitches

Technical issues can also disrupt the direct deposit process. These may include system outages, software bugs, or network problems. Staying informed about Chase Bank's system status can help mitigate the impact of these issues.

Read also:Ankara Styles For Men

Causes of Delayed Deposits

Delayed deposits can be caused by several factors, both within and outside the control of Chase Bank. Below are some of the primary causes:

- Bank holidays: Deposits scheduled on holidays may be delayed until the next business day.

- Payroll processing errors: Mistakes in the payroll system can lead to delays in depositing funds.

- Account verification issues: If the account information is incorrect or incomplete, it can cause delays in processing the deposit.

By understanding these causes, users can take proactive steps to minimize the risk of delayed deposits.

Incorrect Deposit Amounts

Receiving an incorrect deposit amount can be frustrating and disruptive. Below are some common reasons why this issue may occur:

Payroll Errors

Errors in the payroll system can result in incorrect deposit amounts. It's essential to verify the details with your employer to ensure the correct amount is being deposited.

Manual Input Mistakes

Mistakes made during the manual input of deposit information can also lead to incorrect amounts. Double-checking the details before submitting them can help prevent this issue.

Technical Glitches

Technical glitches can occur at any point in the direct deposit process, causing disruptions in the transfer of funds. Below are some common technical issues and their potential solutions:

System Outages

System outages at Chase Bank or the employer's payroll system can delay or prevent deposits from being processed. Staying informed about system status updates can help users anticipate and plan for potential delays.

Software Bugs

Software bugs in either the bank's system or the payroll system can cause errors in the deposit process. Regular software updates and maintenance can help minimize the occurrence of these issues.

How to Resolve Chase Direct Deposit Issues

Resolving Chase direct deposit issues requires a systematic approach. Below are some steps you can take to address these problems effectively:

Verify Account Information

Ensure that the account information provided to your employer is accurate and up-to-date. Any discrepancies can lead to delays or errors in the deposit process.

Contact Your Employer

If you suspect a payroll-related issue, contact your employer's payroll department to verify the details of your deposit. They can help identify and resolve any errors in the system.

Reach Out to Chase Customer Support

If the issue is related to Chase Bank, reaching out to their customer support team can provide assistance in resolving the problem. They can offer guidance and support to help you navigate the process.

Tips for Preventing Future Issues

Preventing future Chase direct deposit issues involves taking proactive steps to ensure the smooth operation of the system. Below are some tips to help you avoid potential problems:

- Regularly update your account information with your employer.

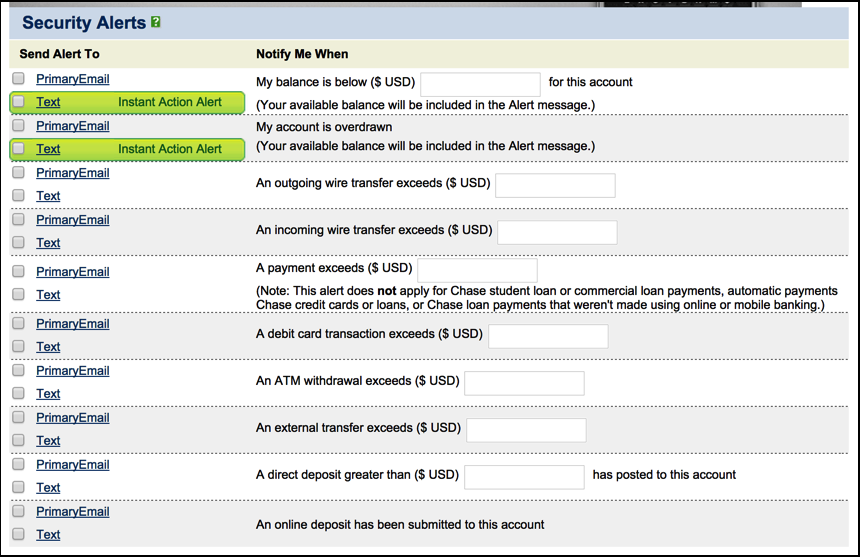

- Monitor your account activity to detect any discrepancies early.

- Stay informed about Chase Bank's system status and any scheduled maintenance.

Contacting Chase Customer Support

If you encounter issues with Chase Direct Deposit, contacting their customer support team is often the best course of action. Below are some ways to reach out for assistance:

Phone Support

Chase Bank offers phone support for customers experiencing direct deposit issues. Calling their customer service hotline can provide immediate assistance and guidance.

Online Support

Chase's online support portal allows users to submit inquiries and track the status of their requests. This can be a convenient option for resolving issues at your own pace.

Alternatives to Chase Direct Deposit

If you're dissatisfied with Chase Direct Deposit or encounter persistent issues, exploring alternative options may be worth considering. Below are some alternatives to traditional direct deposit:

Mobile Banking Apps

Many banks offer mobile banking apps that allow users to deposit checks remotely using their smartphones. This can be a convenient alternative to traditional direct deposit.

Third-Party Payment Services

Services like PayPal and Venmo offer alternative methods for receiving payments electronically. These platforms can provide additional flexibility and security for your transactions.

Conclusion

Chase Direct Deposit is a valuable service that offers convenience and security for millions of users. However, like any system, it can encounter issues that may disrupt the process. By understanding the common problems and their causes, you can take proactive steps to prevent and resolve these issues effectively.

We encourage you to share your experiences and insights in the comments section below. Your feedback can help others who may be facing similar challenges. Additionally, feel free to explore other articles on our site for more information on financial topics and solutions.

Remember, staying informed and proactive is key to ensuring a smooth and hassle-free direct deposit experience. If you encounter any issues, don't hesitate to reach out to Chase Customer Support for assistance. Together, we can ensure that your financial transactions are secure, efficient, and reliable.