Banking plays a pivotal role in the global economy, and organizations like the American Bankers Association (ABA) are instrumental in shaping the industry's landscape. As a critical player in the financial sector, the ABA ensures that banks operate efficiently and adhere to regulations. But what exactly is ABA for banking, and why does it matter? In this article, we'll delve into the intricacies of the American Bankers Association, its functions, and its impact on the banking world.

The American Bankers Association is a powerful advocate for the banking industry, providing resources, support, and guidance to financial institutions across the United States. Its influence extends to policy-making, regulatory compliance, and industry best practices. Whether you're a banking professional or simply curious about how the financial system operates, understanding the ABA is essential.

This article will explore the history, mission, and functions of the ABA while shedding light on its significance in the banking sector. By the end of this guide, you'll have a clear understanding of what ABA for banking means and why it's crucial for the industry's success.

Read also:Mike Fuentes Height

Table of Contents

- Overview of ABA for Banking

- History of the American Bankers Association

- Key Functions of the ABA in Banking

- ABA's Role in Regulatory Compliance

- ABA as an Advocate for Banks

- Educational Resources and Training Programs

- Technology and Innovation in Banking

- Statistics and Industry Trends

- Challenges Facing the ABA

- The Future of ABA for Banking

Overview of ABA for Banking

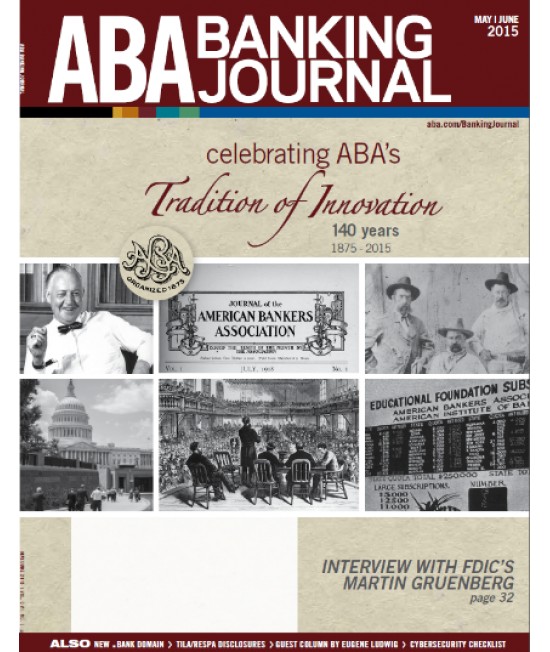

The American Bankers Association (ABA) serves as the voice of the banking industry, advocating for financial institutions of all sizes and ensuring they operate in a fair and competitive environment. Established in 1875, the ABA has grown into a prominent organization that represents banks across the United States. Its mission is to promote sound policies and practices that benefit both banks and consumers.

What Does ABA Stand For?

ABA stands for the American Bankers Association. It is a non-profit organization that provides resources, advocacy, and networking opportunities for banks and financial institutions. Through its efforts, the ABA helps banks navigate complex regulatory environments and stay ahead of industry trends.

Why is ABA Important for Banking?

The importance of ABA for banking cannot be overstated. The association plays a vital role in shaping policies, influencing regulations, and providing educational resources to its members. By advocating for the interests of banks, the ABA ensures that the financial system remains stable and resilient.

History of the American Bankers Association

The American Bankers Association was founded in 1875 in response to the need for a unified voice for the banking industry. Over the years, the ABA has evolved to address the changing needs of financial institutions and the broader economy. From its early days as a small association of bankers to its current status as a leading advocate for the industry, the ABA has consistently adapted to meet the challenges of its time.

Key Milestones in ABA's History

- 1875: The ABA is established in New York City.

- 1930s: The association plays a key role in shaping banking regulations during the Great Depression.

- 1980s: The ABA expands its focus to include technology and innovation in banking.

- 2000s: The association strengthens its advocacy efforts in response to the financial crisis.

Key Functions of the ABA in Banking

The ABA performs several critical functions that benefit the banking industry and its stakeholders. These functions include advocacy, education, and the provision of resources to help banks operate effectively. By addressing the needs of its members, the ABA ensures that the banking system remains strong and adaptable.

Advocacy and Policy-Making

One of the primary functions of the ABA is to advocate for the interests of banks at the local, state, and federal levels. Through its lobbying efforts, the ABA influences policies that affect the banking industry, ensuring that regulations are fair and reasonable.

Read also:Indian Mydesi Net

Education and Training

The ABA offers a wide range of educational resources and training programs to help banking professionals develop their skills and knowledge. These programs cover topics such as regulatory compliance, risk management, and customer service.

ABA's Role in Regulatory Compliance

Regulatory compliance is a critical aspect of banking, and the ABA plays a significant role in helping banks navigate complex regulations. By providing guidance and resources, the ABA ensures that banks can meet their compliance obligations while focusing on serving their customers.

Key Regulatory Issues Addressed by the ABA

- Consumer protection laws

- Anti-money laundering regulations

- Data privacy and cybersecurity

ABA as an Advocate for Banks

As an advocate for banks, the ABA works tirelessly to ensure that the voices of financial institutions are heard in policy-making circles. By representing the interests of its members, the ABA helps create a favorable environment for banks to thrive.

How the ABA Advocates for Banks

- Lobbying lawmakers and regulators

- Participating in public forums and discussions

- Providing research and data to support its positions

Educational Resources and Training Programs

Education is a cornerstone of the ABA's mission, and the association offers a wide range of resources and programs to help banking professionals grow and succeed. These resources include online courses, conferences, and publications that cover various aspects of the banking industry.

Popular ABA Training Programs

- Banking Essentials Certificate Program

- Cybersecurity Training and Certification

- Leadership Development Program

Technology and Innovation in Banking

Technology plays a vital role in the banking industry, and the ABA is at the forefront of promoting innovation and digital transformation. By fostering collaboration between banks and technology providers, the ABA helps drive progress in the financial sector.

Trends in Banking Technology

- Artificial intelligence and machine learning

- Blockchain and distributed ledger technology

- Mobile banking and digital payments

Statistics and Industry Trends

Data and statistics are essential for understanding the state of the banking industry and identifying emerging trends. The ABA provides valuable insights into the financial sector, helping banks make informed decisions and stay competitive.

Key Banking Statistics

- Total assets of U.S. banks: Over $23 trillion

- Number of banks in the U.S.: Approximately 4,600

- Annual revenue of the banking industry: Over $600 billion

Challenges Facing the ABA

Like any organization, the ABA faces challenges in its mission to support the banking industry. These challenges include adapting to new technologies, addressing regulatory changes, and maintaining the trust of its members and the public.

Overcoming Challenges in the Banking Industry

- Investing in research and development

- Collaborating with industry partners

- Engaging in open dialogue with stakeholders

The Future of ABA for Banking

As the banking industry continues to evolve, the role of the American Bankers Association will become even more important. By staying ahead of trends and addressing emerging challenges, the ABA will ensure that banks remain strong and resilient in the years to come.

Predictions for the Future of Banking

- Increased adoption of digital banking solutions

- Growing emphasis on sustainability and ESG practices

- Expansion of fintech partnerships and collaborations

Conclusion

In conclusion, understanding what ABA for banking entails is crucial for anyone interested in the financial industry. The American Bankers Association plays a vital role in shaping the banking landscape, advocating for the interests of financial institutions, and promoting innovation and growth. By staying informed about the ABA's activities and initiatives, you can gain valuable insights into the future of banking.

We encourage you to explore the resources and programs offered by the ABA and engage with the banking community. Leave a comment below to share your thoughts or questions, and don't forget to check out our other articles for more information on banking and finance.

![ABA Banking Industry Response List Review cat[&]tonic](https://cat-tonic.com/wp-content/uploads/may20FD01_blog_image.jpg)