The United States Debt Clock has become a critical topic of discussion in recent years as the national debt continues to grow at an alarming rate. It serves as a real-time tracker of the nation's financial obligations, capturing the attention of policymakers, economists, and the general public alike. The Debt Clock acts as a reminder of the financial challenges the country faces and the need for sustainable fiscal policies. As the numbers on the clock continue to rise, understanding its implications becomes increasingly important for individuals and businesses alike.

Many people wonder why the Debt Clock United States matters so much. The answer lies in the long-term consequences of excessive borrowing. When a government accumulates debt, it affects everything from interest rates to economic growth. Furthermore, the rising national debt can impact future generations, who may have to bear the burden of repayment. In this article, we will delve deep into the mechanics of the Debt Clock, its historical context, and its implications for the U.S. economy.

This guide aims to provide readers with a comprehensive understanding of the Debt Clock United States, ensuring that you are well-informed about its significance. Whether you're an economist, a student, or simply someone curious about the nation's financial health, this article will offer valuable insights into how the Debt Clock works and why it matters. Let's explore the topic further.

Read also:Mens Ear Tattoos

What is the Debt Clock United States?

Definition and Purpose

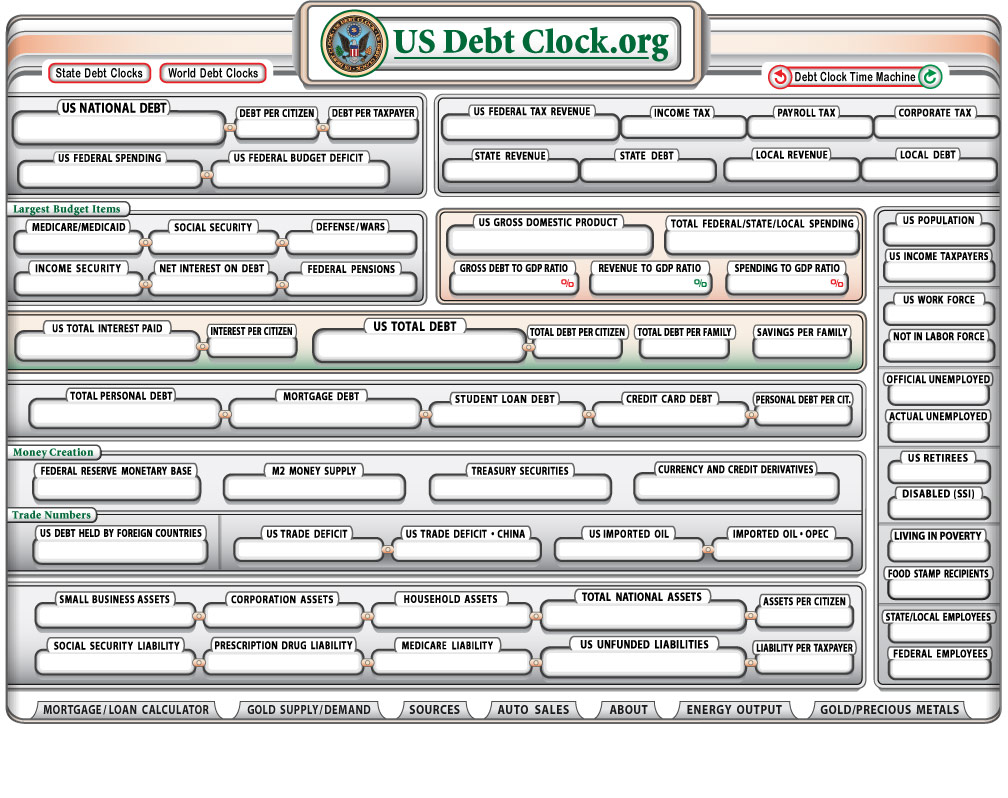

The Debt Clock United States is a digital tracker that displays the country's total public debt in real-time. It serves as a visual representation of the financial obligations undertaken by the federal government. The clock includes both intragovernmental debt (money owed to federal trust funds) and public debt (money borrowed from investors and foreign governments). Its purpose is to highlight the growing national debt and encourage discussions about fiscal responsibility.

According to the U.S. Treasury Department, as of 2023, the national debt has surpassed $31 trillion, making it one of the largest debts in the world. This figure continues to rise due to factors such as government spending, budget deficits, and economic policies. Understanding the composition of the debt is crucial for assessing its impact on the economy.

History of the U.S. Debt Clock

Origins and Evolution

The concept of the Debt Clock dates back to 1989 when New York real estate developer Seymour Durst installed the first Debt Clock in Times Square. It was initially designed to raise awareness about the growing national debt during a time of significant budget deficits. Over the years, the Debt Clock has evolved into a digital platform accessible online, providing real-time updates to people around the world.

The historical context of the Debt Clock is tied to the U.S. government's fiscal policies. During periods of economic downturns, such as the Great Recession of 2008, the national debt surged due to increased government spending and stimulus packages. This trend has continued, with the debt growing faster than the GDP, raising concerns about the country's long-term financial stability.

Components of the U.S. National Debt

Intragovernmental vs. Public Debt

The U.S. national debt consists of two main components: intragovernmental debt and public debt. Intragovernmental debt refers to money borrowed by the federal government from its own accounts, such as Social Security and Medicare trust funds. Public debt, on the other hand, represents money borrowed from external sources, including individuals, corporations, and foreign governments.

Read also:Mtn Apple Music Code

- Intragovernmental Debt: Accounts for approximately one-third of the total national debt.

- Public Debt: Represents the remaining two-thirds and includes Treasury securities held by investors worldwide.

Both components contribute to the overall debt burden, and understanding their differences is essential for analyzing the fiscal health of the nation.

Factors Contributing to the Growing Debt

Budget Deficits and Fiscal Policies

Several factors contribute to the rising national debt, with budget deficits being one of the primary drivers. When the government spends more than it collects in revenue, the difference is financed through borrowing. This has been a recurring issue in recent decades, with factors such as tax cuts, increased military spending, and social welfare programs contributing to the deficit.

Fiscal policies, including stimulus packages during economic crises, also play a significant role in debt accumulation. For instance, the CARES Act and other relief measures implemented during the COVID-19 pandemic led to a substantial increase in the national debt. These policies were necessary to stabilize the economy but came at a significant financial cost.

Implications of the Rising National Debt

Economic and Social Consequences

The growing national debt has far-reaching implications for the U.S. economy and society. One of the most immediate effects is the increase in interest payments, which diverts funds from other critical areas such as education, healthcare, and infrastructure. This can hinder economic growth and reduce the government's ability to address pressing social issues.

Furthermore, the rising debt can lead to inflationary pressures, making it more expensive for businesses and consumers to borrow money. It can also impact the country's credit rating, potentially increasing borrowing costs for the government in the future. These economic challenges underscore the importance of implementing sustainable fiscal policies to manage the debt.

How the Debt Clock Affects Ordinary Americans

Personal and Generational Impact

The Debt Clock United States has a direct impact on the lives of ordinary Americans. As the national debt grows, it can lead to higher taxes, reduced government services, and decreased economic opportunities. Future generations may also bear the burden of repaying the debt, affecting their financial well-being and quality of life.

For individuals, understanding the Debt Clock can help them make informed financial decisions. It highlights the need for personal financial responsibility and encourages saving for the future. By staying informed about the national debt, Americans can advocate for policies that promote fiscal responsibility and economic stability.

Comparing the U.S. Debt Clock with Other Countries

Global Debt Perspectives

While the U.S. Debt Clock is a significant concern, it is essential to compare it with other countries' debt levels. Japan, for example, has one of the highest debt-to-GDP ratios in the world, surpassing 250%. However, due to its strong domestic investor base, Japan's debt is considered more sustainable than that of other nations.

- United States: Debt-to-GDP ratio of approximately 120%.

- Japan: Debt-to-GDP ratio exceeding 250%.

- European Union: Average debt-to-GDP ratio around 90%.

These comparisons provide valuable insights into the global debt landscape and highlight the unique challenges faced by each country.

Strategies for Reducing the National Debt

Potential Solutions and Challenges

Addressing the national debt requires a multifaceted approach that involves both short-term and long-term strategies. Some potential solutions include:

- Implementing fiscal reforms to reduce budget deficits.

- Increasing tax revenues through progressive tax policies.

- Reducing unnecessary government spending and improving efficiency.

- Promoting economic growth to increase GDP and reduce the debt-to-GDP ratio.

However, these solutions come with their own set of challenges, such as political resistance and the need for bipartisan cooperation. Finding a balance between economic growth and fiscal responsibility is crucial for reducing the national debt effectively.

Expert Opinions on the Debt Clock United States

Views from Economists and Policy Analysts

Economists and policy analysts have differing opinions on the Debt Clock United States and its implications. Some argue that the debt is manageable as long as economic growth outpaces borrowing. Others warn of the dangers of excessive debt, emphasizing the need for immediate action to address the issue.

According to a report by the Congressional Budget Office (CBO), the national debt is projected to continue growing in the coming decades unless significant policy changes are implemented. This highlights the urgency of addressing the issue and finding sustainable solutions.

Future Outlook for the Debt Clock United States

Trends and Projections

The future of the Debt Clock United States depends on the fiscal policies implemented by the government and the economic conditions of the country. Projections indicate that the debt will continue to grow unless measures are taken to reduce budget deficits and promote economic growth.

Technological advancements and innovation may play a role in addressing the debt by creating new revenue streams and improving efficiency. However, the success of these efforts will depend on the willingness of policymakers to prioritize fiscal responsibility and long-term sustainability.

How to Stay Informed About the Debt Clock United States

Resources and Tools

Staying informed about the Debt Clock United States is essential for understanding its implications and advocating for change. Several resources and tools are available to help individuals track the debt and its impact on the economy:

- The U.S. Treasury Department's website provides real-time updates on the national debt.

- News outlets and economic publications offer analysis and commentary on debt-related issues.

- Think tanks and research institutions publish reports and studies on the topic.

By utilizing these resources, individuals can stay informed and contribute to discussions about the Debt Clock and its implications.

Conclusion

The Debt Clock United States serves as a critical reminder of the nation's financial obligations and the need for sustainable fiscal policies. Understanding its components, implications, and potential solutions is essential for addressing the challenges posed by the growing national debt. By staying informed and advocating for responsible fiscal management, individuals can play a role in shaping the future of the U.S. economy.

We encourage readers to share this article with others and explore additional resources to deepen their understanding of the topic. Together, we can promote awareness and drive meaningful change in addressing the Debt Clock United States.

Table of Contents

- What is the Debt Clock United States?

- History of the U.S. Debt Clock

- Components of the U.S. National Debt

- Factors Contributing to the Growing Debt

- Implications of the Rising National Debt

- How the Debt Clock Affects Ordinary Americans

- Comparing the U.S. Debt Clock with Other Countries

- Strategies for Reducing the National Debt

- Expert Opinions on the Debt Clock United States

- Future Outlook for the Debt Clock United States