Understanding the concept of an ABA number is crucial for anyone dealing with banking transactions in the United States. An ABA number, also known as a routing transit number (RTN), is a nine-digit code that identifies financial institutions in the U.S. This number plays a vital role in ensuring that funds are routed to the correct bank during transfers.

In today's digital age, where financial transactions occur at lightning speed, having a clear understanding of what an ABA number is and how it works can save you from potential errors and delays. Whether you're setting up direct deposits, paying bills online, or transferring money between accounts, the ABA number ensures that your money reaches its intended destination.

This article will delve into the intricacies of ABA numbers, providing you with a detailed explanation of their purpose, structure, and importance. By the end of this guide, you'll have a comprehensive understanding of what an ABA number is and how it impacts your banking activities.

Read also:Indian Mydesi Net

Table of Contents

- What is an ABA Number?

- The History of ABA Numbers

- Structure of an ABA Number

- Functions of an ABA Number

- Benefits of Using an ABA Number

- Common Uses of ABA Numbers

- How to Verify an ABA Number

- ABA Number vs. SWIFT Code

- Security Concerns with ABA Numbers

- Frequently Asked Questions About ABA Numbers

What is an ABA Number?

An ABA number, or American Bankers Association number, is a unique nine-digit code assigned to financial institutions in the United States. It serves as a digital address for banks, ensuring that funds are routed correctly during transactions such as direct deposits, wire transfers, and automated clearing house (ACH) payments. This number is essential for both personal and business banking activities.

Importance of ABA Numbers in Banking

ABA numbers are critical for maintaining the efficiency and accuracy of the U.S. banking system. They help prevent errors in transactions by ensuring that money is directed to the correct financial institution. Without ABA numbers, the process of transferring funds would be significantly more complicated and prone to mistakes.

- Facilitates seamless transactions between banks.

- Reduces the risk of errors in fund transfers.

- Ensures compliance with regulatory requirements.

The History of ABA Numbers

The concept of ABA numbers dates back to 1910 when the American Bankers Association introduced the routing transit number system. Initially designed to streamline check processing, ABA numbers have evolved to accommodate modern banking needs, including electronic transfers and online payments. Today, they remain a cornerstone of the U.S. financial infrastructure.

Evolution of ABA Numbers

Over the years, ABA numbers have adapted to technological advancements in the banking industry. From manual check processing to digital transactions, these numbers continue to play a pivotal role in ensuring the smooth flow of funds across the banking system.

- Introduced in 1910 for check processing.

- Expanded to include electronic transactions.

- Continuously updated to meet modern banking demands.

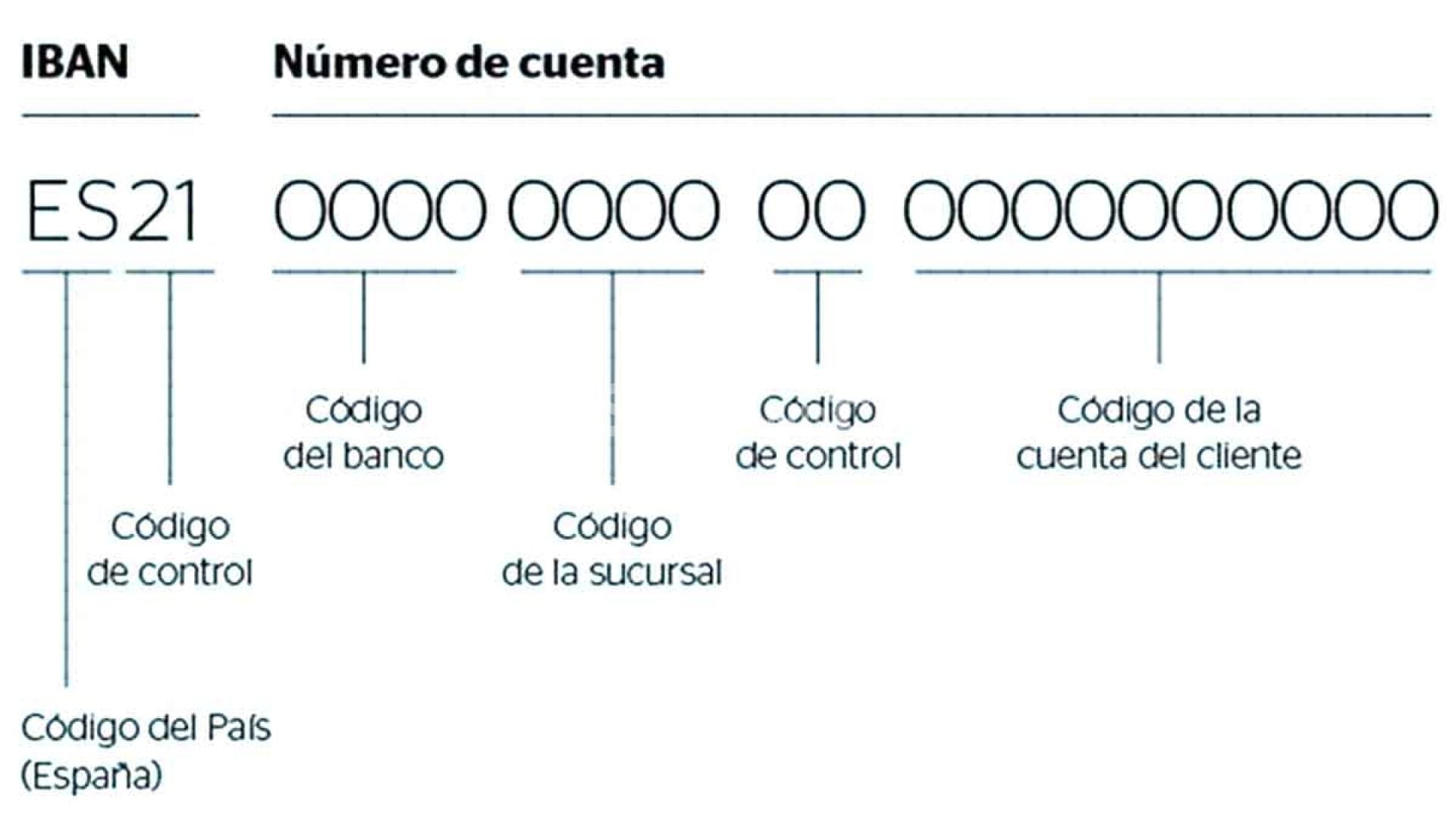

Structure of an ABA Number

An ABA number consists of nine digits, each with a specific purpose. The first four digits represent the Federal Reserve Routing Symbol, while the next four digits identify the bank or financial institution. The final digit serves as a checksum to validate the accuracy of the number.

Breaking Down the ABA Number

Understanding the structure of an ABA number can help you identify potential issues in your banking transactions. Here's a breakdown of each component:

Read also:Ex Nba Players That Are Jehovah Witness

- Digits 1-4: Federal Reserve Routing Symbol.

- Digits 5-8: Financial Institution Identifier.

- Digit 9: Checksum Digit.

Functions of an ABA Number

ABA numbers serve multiple functions in the banking system. They are primarily used for routing funds between financial institutions, but they also play a role in regulatory compliance and fraud prevention. By ensuring that transactions are routed accurately, ABA numbers contribute to the overall stability of the U.S. banking system.

Key Functions of ABA Numbers

- Facilitating domestic wire transfers.

- Supporting ACH transactions.

- Ensuring compliance with banking regulations.

Benefits of Using an ABA Number

Using an ABA number offers several advantages, both for individuals and businesses. It simplifies the process of transferring funds, reduces the likelihood of errors, and enhances the security of financial transactions. Additionally, ABA numbers contribute to the efficiency of the banking system by ensuring that transactions are processed quickly and accurately.

Advantages of ABA Numbers

- Streamlines fund transfers.

- Minimizes transaction errors.

- Enhances transaction security.

Common Uses of ABA Numbers

ABA numbers are widely used in various banking activities. From setting up direct deposits to paying bills online, these numbers are essential for ensuring that funds are routed correctly. Here are some of the most common uses of ABA numbers:

Typical Applications of ABA Numbers

- Direct deposits.

- Wire transfers.

- Online bill payments.

- ACH transactions.

How to Verify an ABA Number

Verifying an ABA number is crucial to ensure the accuracy of your banking transactions. You can verify an ABA number by checking your bank's website, contacting your bank's customer service, or using online verification tools. Always ensure that the ABA number you use is correct to avoid transaction errors.

Steps to Verify an ABA Number

- Check your bank's website for the correct ABA number.

- Contact your bank's customer service for confirmation.

- Use online verification tools to validate the ABA number.

ABA Number vs. SWIFT Code

While both ABA numbers and SWIFT codes are used for routing financial transactions, they serve different purposes. ABA numbers are primarily used for domestic transactions within the United States, while SWIFT codes are used for international transactions. Understanding the difference between these two systems is essential for ensuring that your transactions are processed correctly.

Key Differences Between ABA Numbers and SWIFT Codes

- ABA numbers are used for domestic transactions.

- SWIFT codes are used for international transactions.

- ABA numbers consist of nine digits, while SWIFT codes are alphanumeric.

Security Concerns with ABA Numbers

While ABA numbers are essential for banking transactions, they can also pose security risks if not handled properly. Sharing your ABA number with unauthorized parties can lead to fraudulent activities. To protect your financial information, always ensure that you share your ABA number only with trusted entities.

Tips for Securing Your ABA Number

- Do not share your ABA number with unverified sources.

- Use secure communication channels when sharing your ABA number.

- Monitor your banking activities for any suspicious transactions.

Frequently Asked Questions About ABA Numbers

Here are some common questions and answers about ABA numbers:

What is the difference between an ABA number and a routing number?

There is no difference between an ABA number and a routing number. Both terms refer to the same nine-digit code used to identify financial institutions in the United States.

Can I use my ABA number for international transactions?

No, ABA numbers are primarily used for domestic transactions within the United States. For international transactions, you will need to use a SWIFT code.

How do I find my ABA number?

You can find your ABA number on your checks, your bank's website, or by contacting your bank's customer service.

Conclusion

In conclusion, understanding what an ABA number is and how it functions is essential for anyone involved in banking transactions in the United States. From facilitating seamless fund transfers to ensuring compliance with banking regulations, ABA numbers play a vital role in the U.S. financial system. By following the tips and guidelines outlined in this article, you can ensure that your transactions are processed accurately and securely.

We encourage you to share this article with others who may benefit from understanding ABA numbers. Additionally, feel free to leave a comment or question below if you have any further inquiries about ABA numbers. Thank you for reading, and we hope this guide has been informative and helpful!