IRS help online chat has become an indispensable tool for taxpayers seeking quick and reliable assistance with their tax-related concerns. Whether you're dealing with filing deadlines, payment issues, or complex tax forms, the IRS online chat service offers real-time support tailored to your needs. In today's fast-paced world, having access to instant solutions is more important than ever, and this service provides just that.

The Internal Revenue Service (IRS) recognizes the growing demand for digital solutions, which is why they have invested in enhancing their online chat feature. This platform allows users to connect directly with IRS representatives who are trained to address a wide range of tax-related questions. By leveraging technology, the IRS aims to improve the overall taxpayer experience while maintaining accuracy and security.

As we delve deeper into this article, you will discover everything you need to know about IRS help online chat, including how it works, its benefits, and tips for maximizing its use. Whether you're a first-time user or someone who wants to explore advanced features, this guide will provide valuable insights to streamline your tax management process.

Read also:Brown Haired Female Celebrities

Table of Contents

- IRS Online Chat Overview

- Eligibility for IRS Online Chat

- How IRS Help Online Chat Works

- Benefits of Using IRS Online Chat

- Common Questions Answered via IRS Chat

- Security Measures in IRS Online Chat

- Limitations of IRS Online Chat

- Alternatives to IRS Online Chat

- Tips for Effective IRS Chat Sessions

- The Future of IRS Help Online Chat

IRS Online Chat Overview

What is IRS Help Online Chat?

IRS help online chat is a digital service provided by the Internal Revenue Service to assist taxpayers in resolving their tax-related queries. This service is designed to offer real-time support, ensuring that users receive accurate and timely information. The platform operates during specific hours and is staffed by trained IRS representatives who specialize in various tax topics.

One of the key advantages of this service is its accessibility. Taxpayers no longer need to wait on hold for extended periods or schedule appointments to speak with an IRS agent. Instead, they can initiate a chat session at their convenience, provided they meet the eligibility criteria. This has significantly improved the efficiency of tax-related communications.

History of IRS Online Chat

The IRS launched its online chat service in response to the increasing demand for digital solutions. Initially, the service was limited in scope, but over the years, it has evolved to encompass a wide range of tax-related topics. The IRS continuously updates and enhances the platform to meet the evolving needs of taxpayers, ensuring that it remains a relevant and effective tool.

Eligibility for IRS Online Chat

Not all taxpayers are eligible to use IRS help online chat. To qualify, users must meet certain criteria, including having a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Additionally, the service is primarily intended for individuals and small businesses, meaning large corporations may not be eligible.

It's important to note that the IRS online chat service is only available during specific hours. Typically, the service operates from Monday to Friday, excluding federal holidays. Users are encouraged to check the IRS website for the most up-to-date schedule to avoid inconvenience.

How IRS Help Online Chat Works

Step-by-Step Guide

Using IRS help online chat is straightforward. Below is a step-by-step guide to help you get started:

Read also:Fat Animation Characters

- Visit the official IRS website and navigate to the "IRS Online Account" section.

- Click on the "Start Chat" button to initiate a session.

- Provide the required information, such as your SSN or ITIN, to verify your identity.

- Once verified, you will be connected to an IRS representative who can assist with your query.

Key Features

Some of the key features of IRS help online chat include:

- Real-time communication with IRS representatives.

- Secure platform to protect sensitive information.

- Ability to upload documents for review during the chat session.

Benefits of Using IRS Online Chat

There are numerous benefits to using IRS help online chat. Firstly, it offers convenience by allowing users to resolve their tax-related issues from the comfort of their homes. Secondly, the service is efficient, as users can receive answers to their questions without waiting for extended periods. Lastly, the platform is secure, ensuring that personal and financial information remains protected.

Common Questions Answered via IRS Chat

Tax Filing Assistance

One of the most common questions taxpayers ask during IRS help online chat sessions relates to tax filing. Users often seek guidance on which forms to use, how to calculate deductions, and deadlines for submission. The IRS representatives are well-equipped to address these concerns and provide step-by-step instructions when necessary.

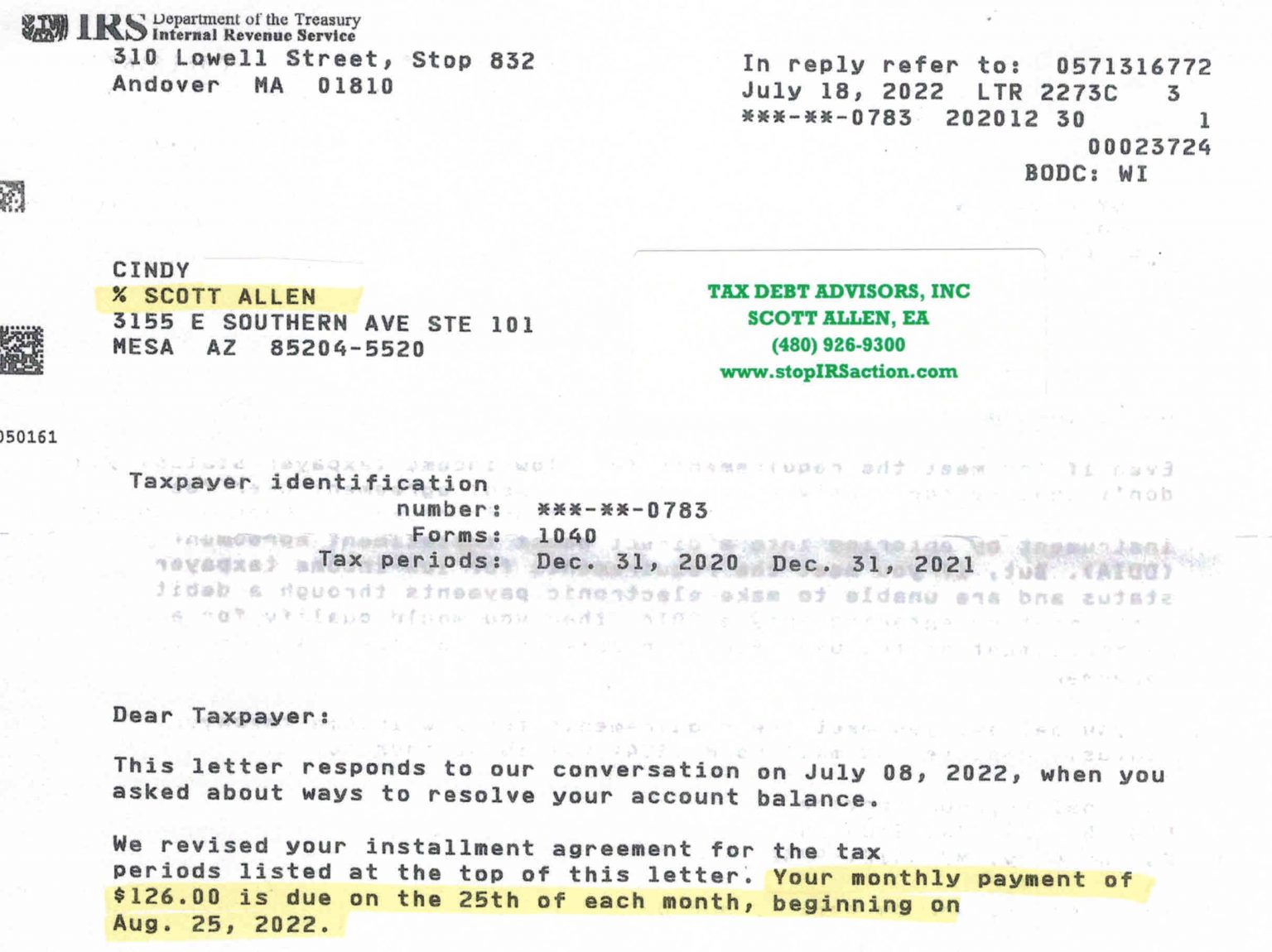

Payment Issues

Another frequent topic of discussion is payment-related issues. Taxpayers may inquire about payment plans, penalties for late payments, or methods of payment accepted by the IRS. The chat service offers clarity on these matters, helping users avoid unnecessary complications.

Security Measures in IRS Online Chat

Security is a top priority for the IRS when it comes to online chat. The platform uses advanced encryption technology to safeguard sensitive information exchanged during chat sessions. Additionally, users must verify their identity before accessing the service, adding an extra layer of protection.

Limitations of IRS Online Chat

While IRS help online chat is a valuable resource, it does have limitations. For instance, the service is not available 24/7, and some complex issues may require in-person assistance. Furthermore, users must have a stable internet connection to participate in chat sessions effectively.

Alternatives to IRS Online Chat

IRS Phone Support

For those who prefer voice communication, IRS phone support is an alternative option. Users can call the IRS helpline during business hours to speak with a representative. However, wait times may be longer compared to online chat.

In-Person Assistance

Taxpayers requiring more detailed assistance can visit local IRS offices for in-person consultations. This option is particularly beneficial for those dealing with complex tax matters that cannot be resolved through digital means.

Tips for Effective IRS Chat Sessions

To make the most of your IRS help online chat experience, consider the following tips:

- Prepare your questions in advance to ensure clarity during the session.

- Have all relevant documents and information readily available.

- Be patient and respectful when communicating with IRS representatives.

The Future of IRS Help Online Chat

As technology continues to advance, the IRS is committed to improving its online chat service. Future enhancements may include expanded hours of operation, increased functionality, and integration with other digital platforms. These developments aim to provide taxpayers with even more convenient and efficient solutions for their tax-related needs.

Conclusion

IRS help online chat is a powerful tool that offers taxpayers quick and reliable assistance with their tax-related concerns. By understanding its features, benefits, and limitations, users can maximize its potential to simplify their tax management process. We encourage you to explore this service and take advantage of the resources it provides.

Feel free to leave a comment or share this article with others who may benefit from it. For more insightful content on tax-related topics, explore our other articles on the website.

Remember, staying informed and proactive is key to managing your taxes effectively. With IRS help online chat at your disposal, you have a trusted ally in navigating the complexities of tax season.